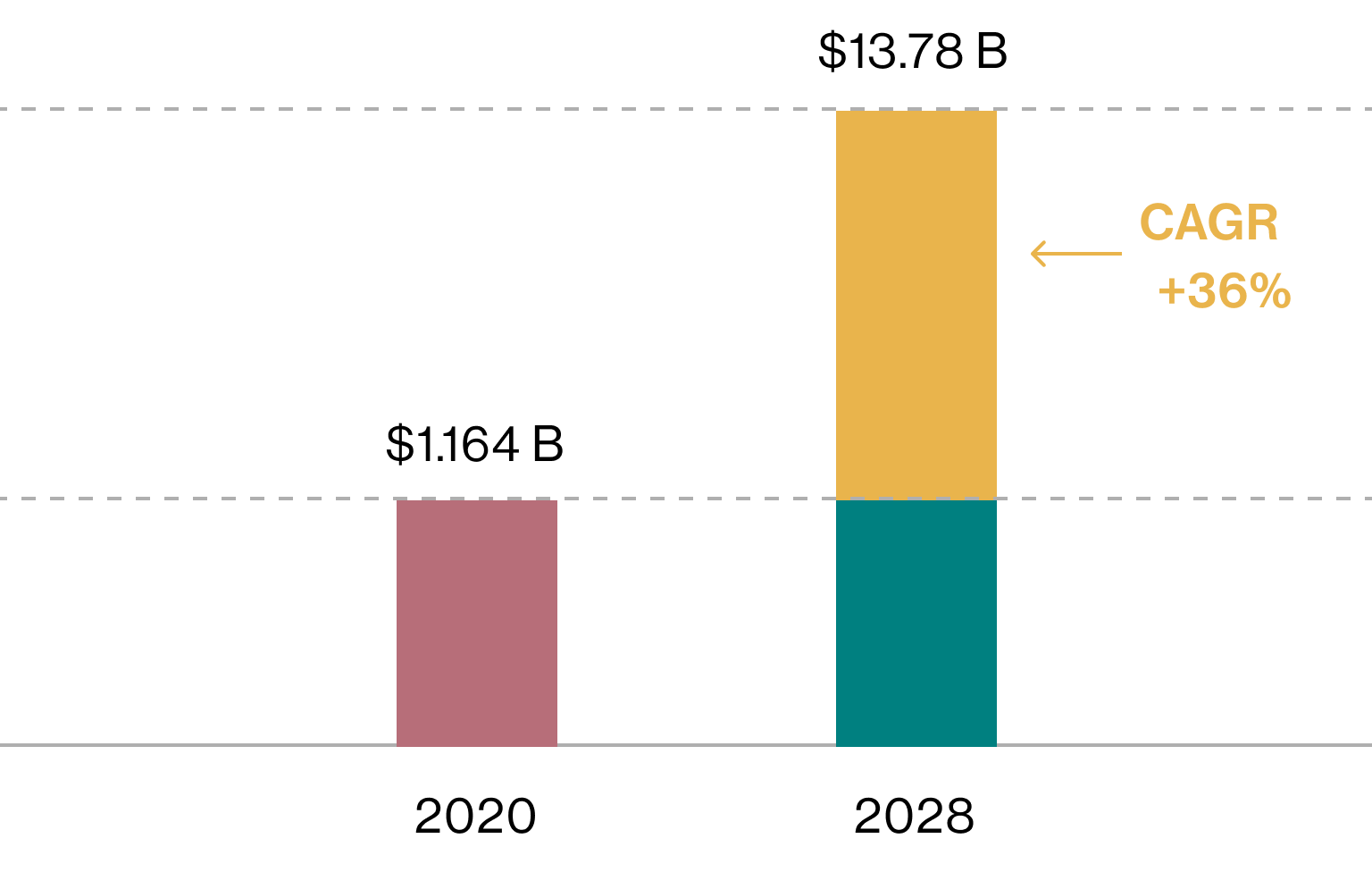

The Freight Brokerage industry is in a period of rapid change. According to a 2021 report by Verified Market Research, the US freight broker market was valued at $1.164B USD in 2020. That number is expected to reach $13.78B by 2028, a CAGR of over 36%.1

US Freight Broker Market Valuation

According to a Verified Market Research 2021 report

With that growth comes the need for new strategies to maintain your current client base and acquire larger contracts. If you’ve tried to work with a Fortune 500 client or have a few that are current customers, you know that it can be very difficult to win and maintain those accounts. Which means, it’s time to change the way you play the game.

The COVID-19 pandemic led many new freight brokers to enter the market to fulfill the increased shipping demands as consumers shopped from home and businesses moved online. This created more competition amongst established freight brokerages, with businesses fighting it out with each other over the commodified points of price, time, and speed of delivery. If these are the only three points you’re selling on, it makes differentiation nearly impossible and cuts into your profitability.

Additionally, there is a growing trend of freight brokerage firms and shippers being pulled into litigation that was previously limited to just the motor carriers. If not properly insured against these risks, the cost of these lawsuits, even if settled, can fold both new and well-established businesses alike.

Now is the time to shift the conversation away from low-value selling points and approach your potential sales with new benefits that you can leverage to win bigger clients. This fresh perspective will help you move from fighting over commodified values to offering a high-value unique selling proposition. These strategies will serve to elevate you above your competition and help you achieve your business growth goals.

Strategy 1: Market your ability to solve problems when things don’t go as expected.

Freight brokers are more than just the agents to help a product get from Point A to Point B. Unfortunately, there are many shippers that do not understand the true value of using a freight broker over entering directly into a contract with a motor carrier. In an effort to “avoid the middle-man”, shippers are making costly mistakes that can have a severe and detrimental effect on their business.

Begin your sales conversations by discussing the value that freight brokers, in general, bring to their business. For many companies (particularly larger shippers), there can be major consequences when their goods do not arrive safely or on time. Freight brokers take on the important work of vetting motor carriers in addition to building relationships and reputations to ensure a smooth transactional experience.

When products are delivered timely, manufacturing and production can continue to operate. A bottleneck in the shipping process may create unhappy channel partners, and consumers who have their workflows interrupted, threatening the shipper’s business. Help your shipping clients understand that a freight broker’s primary goal is to ensure a seamless and scheduled delivery of their products. This, in turn, allows them to grow and maintain a positive relationship with those in their supply chain.

The Hidden Costs of NOT Using a Freight Broker

Shipping clients may try to circumvent the freight broker process in an effort to save on costs. However, few realize the additional cost and liability they take on by bringing the motor carrier coordination process in-house. Shippers who go directly to motor carriers now have to carry additional overhead expenses. For the employee or employees handling shipping logistics, there is the cost of salaries, healthcare, pensions, and other HR-related expenditures. There may also be the added expenses of the office space, utilities, and equipment needed for the individual or professional logistics department to operate.

Perhaps the greater risk, though, is the potential liability that the shipper assumes by working directly with motor carriers. It’s imperative that there is a professional vetting of motor carriers before entering into a contract. This means ensuring that the motor carrier is in full compliance with FMCSA regulations. Additionally, a motor carrier’s insurance coverage may not be high enough to cover the full value of the freight being moved. This would potentially lead the shipper to either acquire additional insurance for their product or take on the risk of something happening to their cargo in-transit. This can be a very costly mistake, with total losses far-exceeding the value of the cargo itself!

The Strategic Advantage of Using a Freight Broker

Shift the conversation to help your potential shipping client understand the true value of using a freight broker for their product delivery needs. It is important to have this high-level buy-in from the shippers so that they are no longer deciding “if” they should use a freight broker, but rather “which freight broker” should they be using.

A shipper may not understand that freight brokerage firms have the technology and expertise in place to ensure that motor carriers:

- Have valid Department of Transportation authority in place.

- Have well-established, proper and sufficient insurance coverage.

- Do not have an “unsatisfactory” or “conditional” safety rating from the FMCSA.

Additionally, as a freight broker, if you are properly insured, you will be providing a much-needed and valuable layer of protection to your shipping clients. We will get more into the liability aspect of the industry in Strategy 2, but it’s important that your shipping clients understand early on that they are opening themselves up to potentially significant liability without the layer of litigation protection that freight brokers provide.

At this level, the goal is to leave your shipping client wondering why anyone WOULDN’T utilize the expertise of a freight broker for their logistics needs. When something goes wrong, freight brokers can be the savior to fix the problem and get operations running smoothly again. Make these benefits clear!

Strategy 2: Leverage how your freight broker authority and insurance protect shippers from litigation exposure

Traffic accidents happen. Unfortunately, in the shipping and motor carrier industry, those accidents can sometimes end a business if they’re not properly covered. Consider just a few of these harrowing transportation statistics:

- There are approximately 4119 fatalities per year involving large truck accidents, averaging 11 fatalities per day.

- here are approximately 160,000 accidents with bodily injury annually, or 438 accidents per day.

- Mannheim Industries, a shipper who directly contacted a motor carrier, had a $30M judgment levied against them in Southern Florida State Appellate Court.

- Motor carriers are only required to have $1M of coverage, but judgments for fatalities in the US have averages closer to $3M per fatality.

- A Florida court recently levied a $1B judgment against a motor carrier involving only one person.

Litigation is particularly prevalent today, and the judgments can be dangerous for all parties involved to continue operations. Litigation expenses and exposure for bodily injury and fatalities arise when goods are moved by a motor carrier. Major liability occurs when freight is moved directly by a motor carrier rather than working with a freight brokerage operation. Plaintiffs are dragging in all involved parties, including shippers and consignees, resulting in litigation that is often, at a minimum, a six-figure legal expense.

It is a costly decision when a shipper decides NOT to utilize the expertise of a freight broker. When a shipper contacts a motor carrier directly, they are at risk for:

- Allegations of negligent hire.

- Allegations of vicarious liability if it’s determined that they exercise too much control over the motor carrier.

This liability for shippers is reduced significantly when a freight broker is the one in communication with the motor carrier.

- Litigation costs and expenses when a motor carrier is involved in an accident while transporting their goods.

- Claims involving bodily injury.

These may be reduced for shippers if they’re covered (listed as “additionally insured”) by freight brokers under their contingent auto liability coverage.

- Judgments including unlimited levels of punitive damages.

- Unpaid cargo claims from motor carriers who have goods in their control during transit.

Freight brokers add an additional level of insurance over cargo coverage for shippers than what a motor carrier might have in place. Because the motor carrier’s cargo coverage may be insufficient, a freight broker that provides this additional coverage will allow shippers to have greater flexibility in selecting their motor carrier. This is a strategic advantage that is particularly beneficial in a market where there is a shortage of available motor carriers.

As a freight broker, if you are adequately protected and have a knowledgeable insurance agent or insurance company behind you to educate and support you, you can leverage that coverage to differentiate yourself. It’s time to shift the perspective of viewing freight broker insurance as just another line-item expense and instead leverage that coverage to differentiate yourself with this valuable benefit over the competition. Use freight brokers insurance as your tool to add value to your current clients and open yourself up to sales opportunities with larger shippers.

Strategy 3. Communicate these value propositions through your branding and marketing

You know the value and unique selling proposition that your freight brokerage business can offer. But are you currently articulating that in your branding and marketing campaigns? Selling on the value points in Strategy 1 and Strategy 2 with help lead your clients down an important decision-making path and help you achieve your goals for growth.

When creating your marketing materials, consider using the following high-level to specific sales conversation strategies:

Create Awareness of the Problem

Educate shipping clients about the potential exposure they face when contracting directly with a motor carrier versus using the knowledge and experience of a professional freight broker.

Explain Considerations of Value

Change the conversation with shipping clients from one of commoditized price points, to high-level value items like protection and supply-chain efficiency. Steer the conversation to one that better reflects the value-added contributions of your freight brokerage business.

Provide Evaluation Tools

Utilize marketing tools to help move shippers into a healthy purchasing decision with case studies highlighting the benefits of using a freight broker and the risks associated with shippers being pulled into litigation.

Close the Sale

Highlight your unique selling propositions to allow you to stand out from your competition. You can base that on the tools and technology you utilize, the experience of your team, statistical success rates and client testimonials, and the valuable protection you can provide to them through your own freight brokers insurance coverage.

Continue Growing the Relationship

Your biggest hurdle may be over once the contract is signed. However, given the cost of acquiring new clients, it’s imperative that you continue the conversations with your shipping clients to educate them on any new risks they should be aware of and how you are actively protecting them from that liability.

Consider using these specific sales conversation strategies, when creating your marketing materials:

Create Awareness of the Problem

Explain Considerations of Value

Provide Evaluation Tools

Close the Sale

Continue Growing the Relationship

We, at Logistiq Insurance Solutions, strive to build long-term partnerships between our knowledgeable insurance agents and the freight broker clients they serve. Our main objective is to stay abreast of this rapidly changing industry and provide the protection you need so that you can continue doing what you do best. Our Broker Shield program has been specifically designed to provide you with peace of mind and provide your shipping clients with the added assurance that their goods will be protected. Let us customize an insurance program to your specific business needs, client and revenue goals, and budget.

Contact us today and let’s discuss how Broker Shield Insurance can be leveraged as the tool you need to grow your freight brokerage business into the future.

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747