The industry game is changing for freight brokers in the United States. If you’re a long-standing, experienced freight broker (and you’re lucky enough not to have been involved in any litigation yet), you may be unaware of the significant increase in legal fines and settlements being levied against freight brokers just in the past few years. Even newer freight brokerage firms and finding themselves caught off guard by litigation they are pulled into as a result of the actions of their contracted motor carrier. Here are some of the most common operational mistakes that freight brokers are making today that increases their exposure to litigation.

Litigation in the Freight Broker Industry Today

With the rise in e-commerce and domestic transport needs in recent years, there is an unfortunate trend that is also growing in the freight broker industry—increased litigation. Traffic accidents involving motor carriers inevitably happen; however, WHO is liable, and for what amount is where things are shifting. There are approximately 4,119 fatalities annually that involve large trucks each year, or 11 large truck fatalities every day. There are approximately 160,000 auto accidents that result in bodily injury every year, 438 injuries per day.

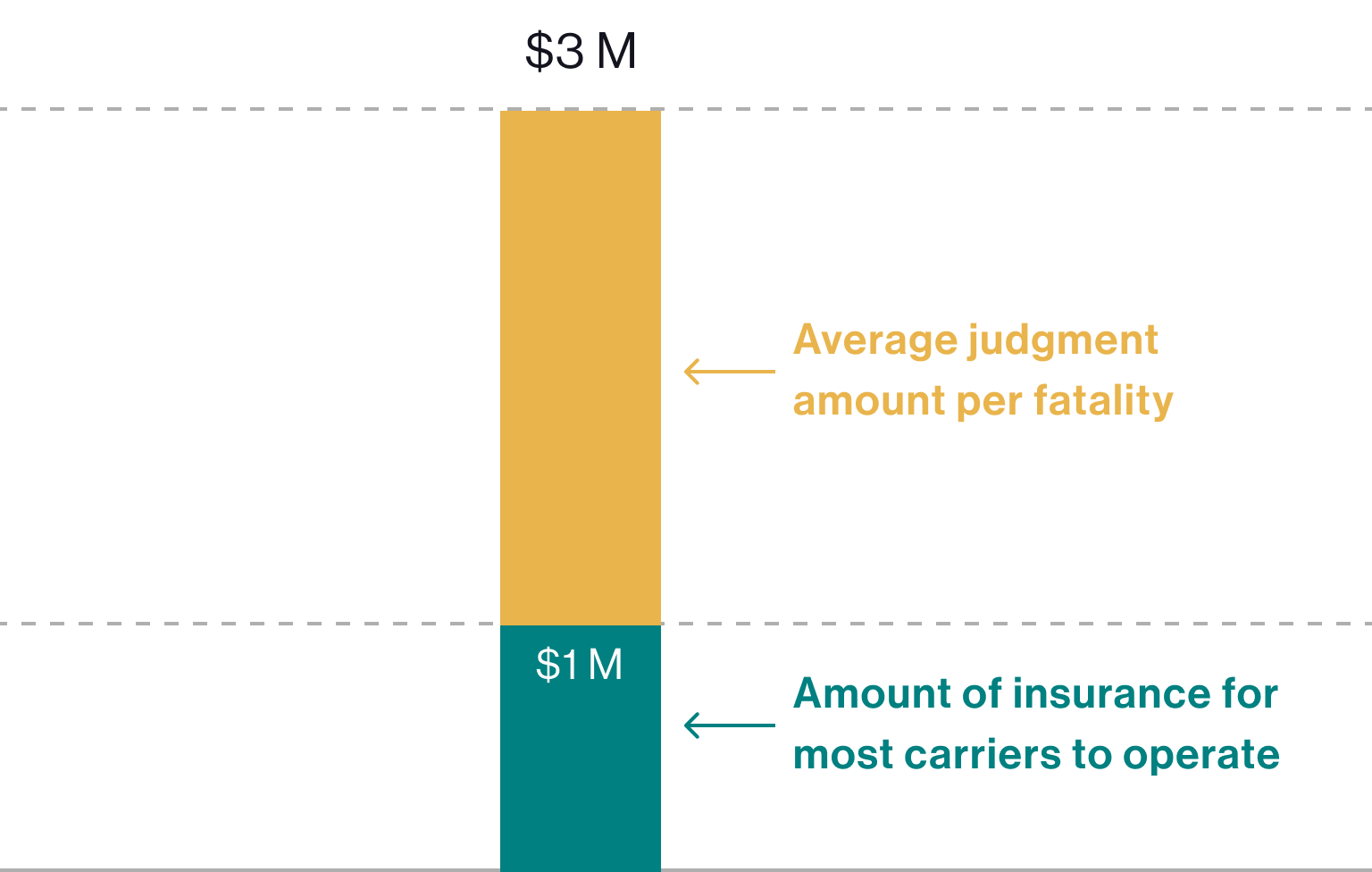

Most motor carriers are only required to have $1,000,000 of insurance coverage to operate. This is immediately problematic given that accidents involving a fatality are now seeing judgments that average about $3,000,000 per fatality in the United States. This lack of insurance coverage, coupled with increased judgment amounts, is leading attorneys to pull in as many related parties as possible, including freight brokers and shippers, so that their client can receive the full amount awarded to them.

Litigation in Freight Broker Industry

Perhaps what is even more concerning is that freight brokers are operating in ways that they don’t even realize open them up to more litigation. What were once attempts to guarantee more timely service, incentivize drivers to perform well, or ensure communication throughout the shipping process can now be used as examples of overreach by a freight broker into the domain of the motor carriers’ work.

With today’s “nuclear settlements,” including a recent judgment against a motor carrier for $1B in Florida, it is imperative that freight brokers continue to educate themselves on ways to conduct business while protecting their brand. The two main areas in which freight brokers are finding themselves liable are allegations of negligent hire and allegations of vicarious liability. Let’s explore more about what these terms mean for your freight broker business.

Understanding Allegations of Negligent Hire

Allegations of Negligent Hire, in the simplest terms, means that a freight broker did not do enough work when hiring a motor carrier. Just because a motor carrier is licensed, does not imply that they are competent and careful to complete the shipping job. If a freight broker has not done their due diligence to vet the safety rating of a motor carrier and there is an accident, the freight broker then becomes an involved party in the litigation.

This becomes increasingly complicated with domestic shipments across state lines due to the varied requirements by states of what is considered “sufficient” in the vetting process. While federal preemption, or the ability for the federal standard of vetting to override the state requirement, should set the standard, cases like that of a 2016 accident involving the freight broker C.H. Robinson demonstrate that federal preemption is not always upheld. Freight brokers need to utilize a robust and documented vetting process. To reduce this risk, freight brokers can do the following for their motor carrier clients:

Validate that a motor carrier has proper authority in place.

Have they met compliance requirements, and can they legally offer the types of services they’re providing?

Consult the Department of Transportation safety scoring for motor carriers.

They will have a rating of Satisfactory, Unsatisfactory, Conditional, or Non-Rated. Unfortunately, the Federal Motor Carrier Safety Administration does not have the resources to give all motor carriers a rating. In fact, 85-90% of truckers on the road do not have a safety rating. Even still, this can be an overlooked step that reflects poorly on a freight broker if they do not perform their due diligence.

Verify that the motor carrier has a valid insurance policy in place.

The freight broker must get the insurance coverage details for every motor carrier with whom they contract. For the most accurate version of the policy, it may be best to acquire the current certificate from the motor carrier’s insurance agent directly. The insurance underwriter should have thoroughly evaluated the motor carrier’s past claim history, financial records, past hiring and firing practices, and maintenance records. This is used as the primary defense against negligent hire claims.

While fears around not doing enough may have you scrambling for more investigation and documentation into your motor carriers, you also have to make sure not to swing too far in the opposite direction into the realm of vicarious liability.

Understanding Allegations of Vicarious Liability

Allegations of vicarious liability occur when a freight broker has done too much regarding the operations of the motor carrier business or drivers. Freight brokers must be clear to act as intermediaries between shippers and motor carriers rather than taking on (or appearing to take on) a supervisory role to the motor carrier. This is defined in courts as a principal-agent relationship.

Vicarious liability is especially dangerous because it expands a freight broker and shipper’s limited liability under the law to the unlimited liability of a motor carrier. However, it is important to note that your shipping clients can reduce their vicarious liability by contracting with a freight broker, rather than contracting directly with a motor carrier. It is to a shipper’s legal advantage to use a freight broker for their transit needs… though they may not realize that benefit.

Sales Mistakes That Open Freight Brokers Up to Risk

There are several ways in which freight brokers can open themselves up to increased exposure to litigation across multiple departments within the company. One way this happens within the sales department is when contracts with shipping clients are not thoroughly reviewed. Shippers are responding to the current uptick in litigation by getting more aggressive with their contract terms, not realizing that they may be inadvertently opening themselves up to allegations of vicarious liability.

Conversely, generalized contracts from shippers that haven’t been reviewed for relevance may include stipulations that are unrelated to a shipper/broker relationship. By using a generic contract without proper review, it may give the appearance that the shipper is trying to exercise a level of control or involvement with their broker that is not acceptable in the eyes of the law (nor relevant to the actual relationship between the two businesses).

In both cases, the freight broker sales teams can benefit from educating their potential shipping clients about the insurance coverage and protection that a freight broker provides. When the shipping company understands that the freight broker provides them with an important layer of protection against being pulled into motor carrier lawsuits, they may be more likely to allow for negotiation on the contract terms.

Marketing Mistakes that May Make Freight Brokers Liable

Language is important in the sales contracts with shippers and motor carriers, but it’s also essential in the marketing of your freight broker business. One freight brokerage firm learned this the hard way after marketing themselves as a “one stop shop” for transportation needs. By holding themselves out as both a conductor of the logistics between a shipper and carrier AND giving the impression that the transportation vehicles were part of their freight brokerage company, they were found to be vicariously liable for an accident involving the motor carrier.

Freight brokers must make clear in their marketing that they are not the transporter of the goods and are not in a position to control or supervise the motor carrier truckers. Freight brokers are the connectors and facilitators in the transaction and must effectively communicate that role. They can, however, share with their shipping clients the value and additional protection of their freight broker’s insurance policy to help safeguard the shipper from potential litigation.

Operational Mistakes to Avoid as a Freight Broker

Operational mistakes are perhaps the biggest way that a freight broker can increase their exposure to allegations of negligent hire or vicarious liability. As mentioned above, allegations of negligent hire most often occur when a freight broker has not properly vetted a motor carrier for safety. Seeking a Department of Transportation safety rating is no longer enough.

The freight broker acts as the connector between shipping companies and valid motor carriers with proper authority. However, freight brokers can also overstep and become vicariously liable for their involvement with the motor carrier. Practices such as being on-site for the cargo loading process, communicating with the driver during transit, or taking on a role that appears supervisory to the driver all open the freight broker to risk. Additionally, freight brokers should not plan routes, advance funds for fuel costs, or assume responsibility for the freight.

Freight brokers also need to be cautious of the expectation they set for their shipping clients. Some freight brokers have gotten burned by litigation for imposing incentives or penalties on drivers related to the efficiency or timeliness of the transport. Again, this is an overstep of the freight broker’s role as the arranger of transportation. It is important that employees of freight brokerage firms understand that activities like moving, cleaning, supervising, or supplying goods/materials to a motor carrier increase the company’s exposure. Freight brokers should strive to maintain as much legal distance as possible from the motor carriers they are contracting with, so as not to be viewed as a principal-agent relationship.

Staying Educated on the Evolving Legal Landscape of Freight Brokering

We understand that this may feel overwhelming to be caught on the tightrope of the current legal landscaping: concerned about doing too much and concerned about doing too little. The good news is that with education and proper insurance coverage, freight brokers and the shippers they contract with can all be more protected in the future.

Our team at LogistIQ is dedicated to understanding and supporting the freight broker industry. In fact, it’s what we’ve done for the past 45 years. We are committed to staying on top of emerging trends and supporting our clients, not only with the insurance products they need to protect their business, but with the education and resources they can benefit from. Even new freight brokers who may feel that proper insurance coverage is out of reach can now enter the market competitively. Our Broker Shield program is designed to protect US freight brokers in today’s market.

We are a robust risk management consulting service, monitoring the industry, reviewing contracts, aiding with the evaluation of motor carriers, and much more. Contact us directly here and learn how LogistIQ can help position you for safety and success in the years ahead.

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747