Insurance can be a tricky topic, especially for freight brokers who are now more prone to litigation than ever before. Here are four of the most common myths we hear when it comes to freight broker insurance and why we need to dispel them once and for all so that your business is protected. And if you’re still not sure what insurance is right for your business, set up a free consultation with one of our agents to learn why freight brokers trust Broker Shield to meet their unique business needs.

Why Freight Brokers Don’t Realize Their Risk?

We’ve been working with freight brokers for years– over 45 years actually! In that time we’ve seen the landscape of the freight brokerage industry change drastically, particularly over the past decade. Unfortunately, some older freight brokers haven’t changed their business model or practices to adapt to new risks in the market. Conversely, some newer freight brokers aren’t yet aware of what those risks are.

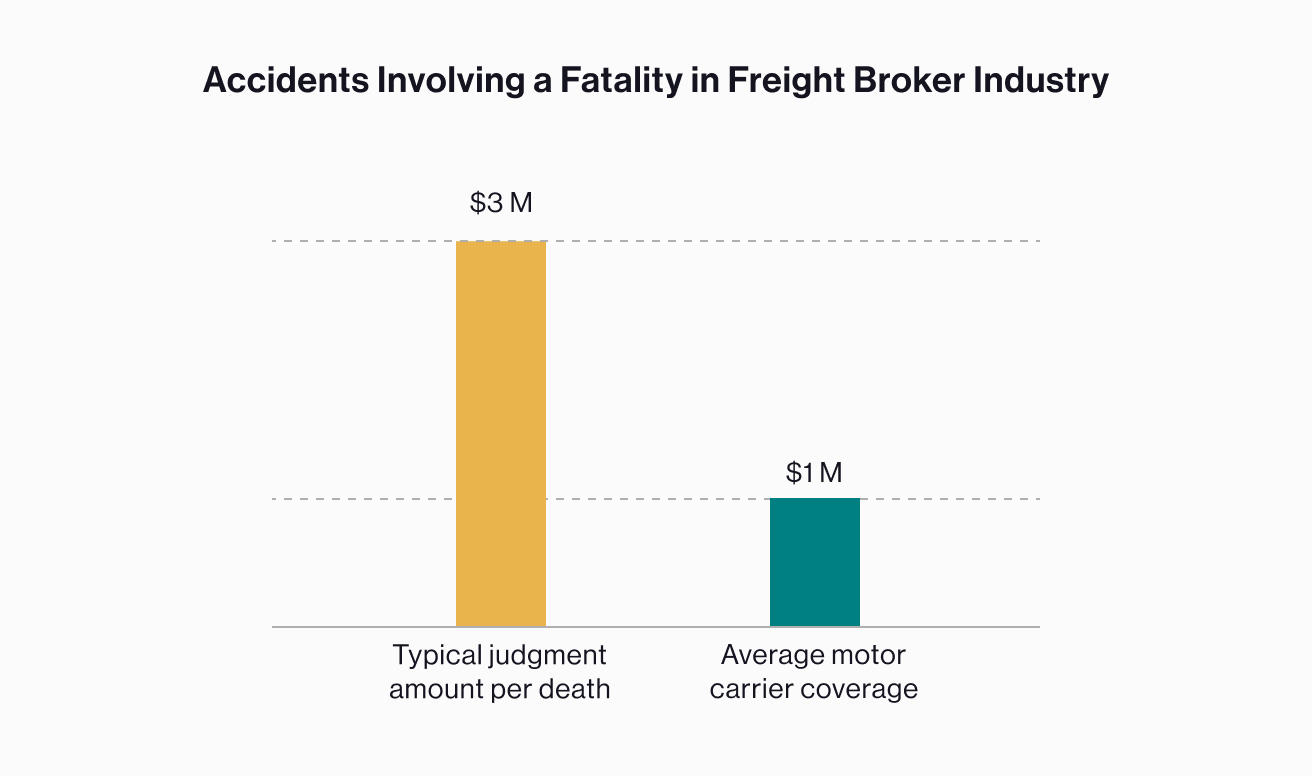

In the past, most motor vehicle accidents involving motor carriers fell on the motor carrier’s insurance company for coverage. Today, however, motor carriers may not carry high enough limits to meet the limitless judgment amounts for accidents and injuries. Each accident that involves a fatality now has a typical judgment amount of $3M per death, far above the average motor carrier coverage of $1M. And with approximately 4,119 fatalities annually that involve large trucks each year, or 11 large truck fatalities every day, the odds of being connected to an accident and pulled into litigation have increased tremendously for freight brokers just in the past few years.

Freight brokers do have ways to protect themselves through insurance coverage, so long as they don’t let these common myths stand in their way.

Myth 1: General Liability Is Enough

General liability means that, as a freight broker, you have broad coverage over any litigation that might come your way, right? This is a common misconception and one that needs to be cleared up immediately.

There are two important things to understand with General Liability Insurance:

- All freight brokers should carry it.

- It does not protect you in situations involving motor carrier accidents.

As freight brokers, you are the conduit that facilitates transactions between shippers and motor carriers, however rarely are either party on your site. A General Liability policy is intended to respond to the financial risk that can be assumed for third-party bodily injury claims occurring on your premises. It’s important if there is an accident involving one of your employees or someone visiting your office, however if the scheme of your business this is not where litigation risk is most typically found.

Because of the low risk involved, most General Liability policies are relatively affordable and it makes sense for all freight brokers to carry it. Just don’t get caught up in the myth that it is enough to protect the scope of your services.

Myth 2: Motor Carriers Are The Ones With The Risk

In the past, this idea made sense– motor carriers were the ones doing the active loading, transporting, and unloading of cargo. Of course they should be the ones to bear the brunt of litigation if they cause an accident, injury, or damage to goods.

However, freight brokers today are finding themselves pulled into litigation with motor carriers that they’ve contracted with and are suddenly unprepared to meet the legal costs involved, regardless of whether they’re found liable or not. Why is this happening?

- Allegations of negligent hire are made against freight brokers when it is believed that they did not do enough work to vet the credentials and reputation of the motor carrier.

- Allegations of Vicarious Liability are made when a freight broker is overreaching and doing too much in an effort to exercise control over the motor carrier (or when a shipping company exercises too much control over a freight broker).

While there are actions that freight brokers can take to minimize their risk of being found liable for either allegation, it still doesn’t mean that freight brokers are entirely protected for legal costs and settlements. Third-party Auto Liability insurance is one vehicle of protection that automatically covers litigation costs if you’re sued and even settle the lawsuit if held liable.

Broad Form Cargo Insurance is another worthwhile type of coverage to explore when it comes to motor carrier losses. This type of insurance will cover you against any loss/damage to the shipment and can be essential in closing the gaps that the carrier’s policy might be having. And that is something your shipping clients will surely appreciate!

Myth 3: Insurance Used to Be Cheap. I Can’t Afford Today’s Policies.

This myth is not entirely wrong, but it’s missing the full picture. The truth is that years ago many freight brokers were able to find really cheap insurance policies. However, the old adage “you get what you pay for” really rang true. Freight brokers found that when they did, in fact, need coverage their claims were being denied or they were receiving really poor service. Even worse, if you did have to file a claim and you got paid something, chances were good that your policy would not be renewed in the future.

This model was not sustainable for the questionable companies writing cheap policies, particularly as litigation amounts continued to rise for freight brokers. Many disreputable insurance companies have since left the market, leaving a handful of the more ethical insurance providers to carry the load.

Insurance is more expensive today, however unlike the policies of this myth, you are actually purchasing a service of value. Not only can having proper freight brokers insurance protect you from potential legal ruin, it can also serve as a vehicle to land you contracts with the larger shipping clients that demand to see that protection in place. (We’ll discuss this more in Myth #4).

Do not be dissuaded just because another freight broker shared with you how much they paid for coverage and it seems out of reach. Freight broker insurance value is actually very tailored to the size and limits of coverage that each freight broker business needs. It is never a one-size-fits-all policy.

With no cost to getting a quote, it is worth it to speak with insurance agents to explore what your options are and see if the coverage you’ve been hoping for is really within reach. With that said, we do advise you to follow two pieces of advice:

- Make sure you’re working with an agent that truly understands your business and the risk of the freight broker industry.

- Do not let an agent steer you toward cheap coverages that will not do much in the event of a loss or trial.

Make sure that the dollars you’re spending on your insurance policies are adding value to your business, rather than focusing on how low you can keep your insurance expenses.

Myth 4: Insurance Is Just a Necessary Business Expense with Little Value.

We understand where you’re coming from here. In an industry that is becoming even more commodified, with freight brokers battling over price and delivery time, few people are seeing how their insurance coverage can actually be used as a tool to leverage sales, rather than a line item expense.

But if you’re tired of trying to offer the “best price” and “fastest delivery” to your potential shipping clients, here’s a way to differentiate yourself from the competition AND offer a unique value proposition that your suppliers want– offer protection.

Even large shipping clients may be completely unfamiliar with how their cargo is actually protected (or not protected) by motor carrier insurance plans. When shippers look to contract directly with motor carriers, they may not realize that they are opening themselves up to a significant amount of legal exposure.

Working with a freight broker not only provides shippers with one-step removal from the motor carrier operations, but it can also give the shippers additional legal and cargo protection based on the freight broker’s policy. Many shipping companies want to have this coverage, but are not always savvy as to the best way to get it from their freight brokers.

Shippers who are becoming wiser about the risks of litigation are now placing higher insurance demands on freight brokers, sometimes preventing smaller brokers from being able to compete. Larger freight brokers may also be feeling pressure to sign shipping contracts that actually open up both the shipper and broker to greater legal liability due to the potential for allegations of vicarious liability. In both scenarios, working with an insurance company that is experienced in the freight broker industry will help you get a policy that meets everyone’s needs.

Finding the Coverage That Your Shipping Clients Will Appreciate

If you want to change your ideas (and dispel the myths) around what you think about freight broker insurance, it’s important that you work with an insurance company with experience. You have unique needs and challenges and should work with an agent who understands your business’s ins and outs, so that you get the protection you need and at a price that works for you.

At LogistIQ we have over four decades of experience working in freight broker insurance– just freight broker insurance! We have been the trusted advisors of many freight broker companies and have a solid reputation with our agents to help our clients mitigate risks in the market and meet the coverage needs of their ideal shipping clients. Contact us today to learn how LogistIQ’s Broker Shield program can change your beliefs around insurance.

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747