Listen, we need to have an important talk. We hear what you’re saying. The insurance industry is fiercely competitive. Differentiating yourself with commoditized insurance products while catering to clients that are laser-focused on price can be tricky. But whether you’re new to the freight-broker insurance market or if you’ve always focused on being a motor carrier insurance provider, we want you to know that we are more than just a line of insurance products for you to sell.

It’s time to get strategic with your freight broker client conversations, and we’re here to help guide you with the resources, tools, and statistics to differentiate yourself in the insurance market and add real value to your freight broker clients.

Let’s walk through how we can shift your freight broker client conversations from a price-driven approach to a value-driven exchange that will help:

- Increase the number and dollar value of sales you close

- Provide superior service to your freight broker clients

- Allow your freight broker clients to offer a unique sales proposition to their shipping customers

We understand that freight brokers may not be your primary client base (yet), but by partnering with Logistiq, you are partnering with someone who is already a dedicated expert in the freight broker industry and has the tools and consulting services needed to grow that line of business.

Our goal is to help you better qualify your freight broker clients and get them into the insurance programs that will best serve them while increasing the transactional velocity to close sales faster and more efficiently.

It’s time to flip the script on selling freight broker insurance to our clients. Let’s discuss some of the most common objections potential clients have to purchasing freight broker insurance and how you can best overcome those objections.

Why There is a Sudden Need for Freight Brokers to Have Insurance

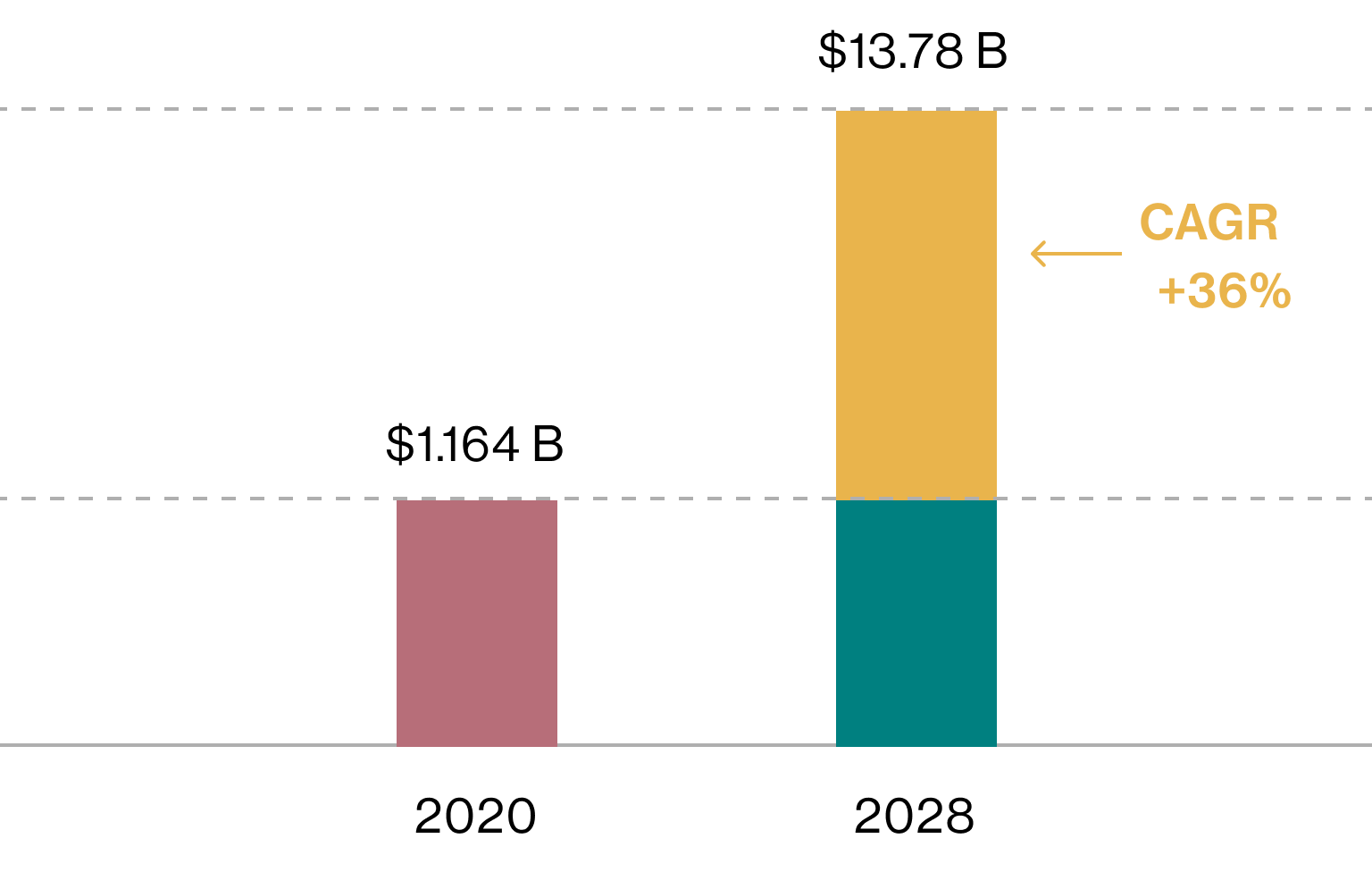

The need for freight brokers grew tremendously due to COVID-19. As consumers shifted their spending habits to shopping online, the demand for domestic shipping surged, and so did the need for freight brokers to handle the logistics of connecting suppliers with shipping companies. According to a 2021 report by Verified Market Research, the US freight broker market was valued at 1.164B USD in 2020. That number is expected to reach $13.78B by 2028, a CAGR of over 36% .1

US Freight Broker Market Valuation

According to a Verified Market Research 2021 report

Interestingly, even with the volume of business handled by freight brokers today, freight broker insurance is not legally required to operate. For those operating in an industry where margins may be slim, and competition for shipping clients is fierce, why would a freight broker want to have an additional insurance expense on their books?

There are two Key Reasons for Needing Proper Insurance Coverage:

- Freight Brokers are more susceptible to litigation than ever before. These lawsuits often lack limits to the amount a company can be sued for. As a result, without proper insurance coverage well-established freight brokers are now being put out of business. Here are some examples of US cases where freight brokers were pulled into litigation within the past several years.

- Having proper freight broker insurance coverage will make your clients more competitive in the market. Newer freight brokers, especially, may not see that freight brokers insurance is affordable to them and can actually be used as a vehicle to make them more competitive.

Two Key Reasons for Needing Proper Insurance Coverage:

- Freight Brokers are more susceptible to litigation than ever before

- Having proper freight broker insurance coverage will make your clients more competitive in the market

At Logistiq, our Broker Shield insurance program is here to help you educate your clients and become a partner in their success.

Step 1: Initiating the Conversation with Your Freight Broker Client

We’re in the business of creating insurance strategies for our agents to sell to their customers. But to develop any good strategy, we need to know exactly what we’re working with.

Begin by asking your freight broker clients about their business model:

- Why type or types of freight are you coordinating transport for?

- What are your annual or estimated annual gross freight receipts (GFR)?

- What types of corridors are you moving freight to and from?

- Tell me more about the nature of the motor carriers you’re using. Do you have a limited number of motor carriers you work with, or are you choosing from anyone available in the market?

Your client may be curious as to why you need to know this information since many insurance policies are a “one-size fits most” type of product. Here’s a short script to incorporate:

“As an insurance agent, I represent Logistiq, a company that specifically understands the freight broker industry and the hurdles to growth that you may face. By learning more about your company’s operations, I can better tailor a program that specifically fits your business.”

Step 2: Shifting from a Price-Driven to a Value-Driven Perspective

The second step in the conversation is one of the most important. Many people have the mindset that insurance is just an operating expense that reduces their bottom line. It may be easy to sell on price if you’re offering the cheapest product out there. It is harder to sell based on value, especially if that value may not be immediately clear to your freight broker client.

If you find the conversation with your freight broker clients shifting to concerns about cost, you can direct the conversation to the value that can be added by investing in insurance.

“The fact that you’re asking about pricing leads me to believe you’re not leveraging your insurance as a tool to help you grow your practice. Think about how insurance is protecting your shipping customers. You can promote that as a reason why your shipping clients should be working with you. It’s an opportunity for you to win more shipping deals because you’ll be keeping them safer.”

Continue the conversation by working to understand their business goals:

- What are your goals for gross freight receipts this year and in the future?

- What are the biggest challenges you face with achieving this growth?

The first answer will be easy. Nearly everyone’s response will be “to increase GFR”. The second question is how you shift from a price-based to a value-based conversation.

We have learned that the most common challenges facing freight brokers today are:

- Competition is fierce between freight brokers.

- Freight brokers struggle to identify and communicate their value proposition to shipping clients.

- Freight broker pricing is commoditized.

- Shippers are placing increasing demands on freight brokers to take on more liability.

Now is the time to explain to your freight broker client that insurance protection is a value proposition.

Step 3: Adding Value with Freight Broker Insurance

Let’s break down each of the most common challenges to understand the role that freight broker insurance can play in overcoming that obstacle to growth and what you can say, as an insurance agent, to your freight broker clients.

![]()

Competition – With such rapid growth within the freight broker market, the competition for shipping clients is greater than ever.

“Because having freight broker insurance is not an industry requirement, carrying a policy like Broker Shield offers an immediate differentiator from your competition. Broker Shield offers two important benefits. It protects you and provides an additional layer of protection to your shipping clients. The program also provides you with the latest information on industry risks and strategies to mitigate those risks. Being more aware of the risk and managing your business accordingly protects you and makes you a more trustworthy player in the industry.”

Value Proposition – Freight brokers may struggle with sales if they are unable to identify or adequately communicate their unique value proposition.

“Broker Shield insurance offers resources that you can provide to your shipping clients about the additional protection they’ll receive by doing business with you. Additionally, Logistiq has educational tools for you on how to mitigate risks within your industry, making you a safer option for your shipping clients to use.

You can educate your shipping clients that there is no stopgap if they skip the broker process and go directly to motor carriers. Your shipping clients are best served by having your products shipped through a company that you have vetted.”

Commoditized Pricing – Freight brokers have little negotiating power with price when it comes to landing a shipping contract.

“Being in an industry with commoditized pricing is the EXACT REASON you can benefit from freight broker insurance. Rather than an operating expense, you can use it as a means to offer more value and protection to your shipping clients at the same rate. Even smaller freight broker clients are surprised to learn that $1 million of coverage often only costs around $3,000 per year. That insurance will pay for itself in very little time given the number of potential contracts you’ll be able to bid on.”

Contract Demands – Large shipping companies are aware of the recent litigation trends and therefore place greater demands on freight brokers that are outside of the normal scope of business. Here is an example of a vicarious liability suit for the past few years: Freight Brokers Vicariously Liable For Carrier Negligence: California Trial Court Creates New Public Policy – Atlantic Legal Foundation.

“How you hold yourself out to the public in branding and marketing can expand your liability as a freight broker to that of a motor carrier. This is known as vicarious liability and opens you up to unlimited liability levels. With no insurance, you may be out of business. With Broker Shield insurance and following their risk mitigation strategies, you will be far more protected and can offer an additional layer of valuable protection to those businesses you contract with.”

Use Freight Broker Insurance as Your Vehicle to Revenue Growth

The Broker Shield insurance program is both preventative (through risk management) and protective (after litigation). Insurance should not be viewed as a capital expense but as an investment opportunity for growth. Broker Shield can help increase a freight broker’s top line through more sales opportunities, while the specific insurance policies protect their bottom line.

Let us, at Logistiq, be a part of the conversation when you are selling to freight brokers. We’re here to help support you and close the deal. It’s just an additional service we offer to make our insurance agents’ jobs a little easier. Contact us today to learn more.

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747