Recent data and analyses paint a worrying picture of cargo theft trends, emphasizing the importance of adequate insurance for freight brokers in order to mitigate potential losses. Below, we’ll highlight some key findings and draw conclusions on what exactly you should be doing to mitigate the risks to your business.

Shift in Cargo Theft Trends

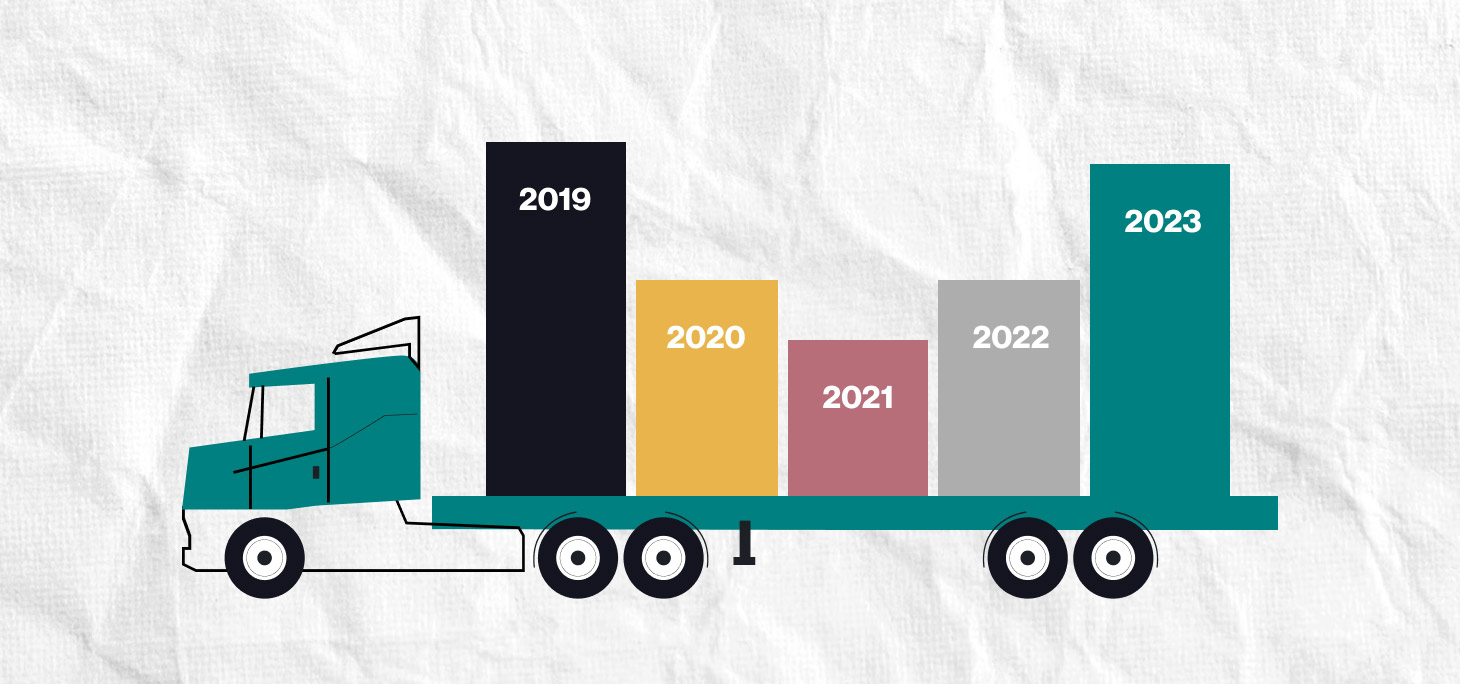

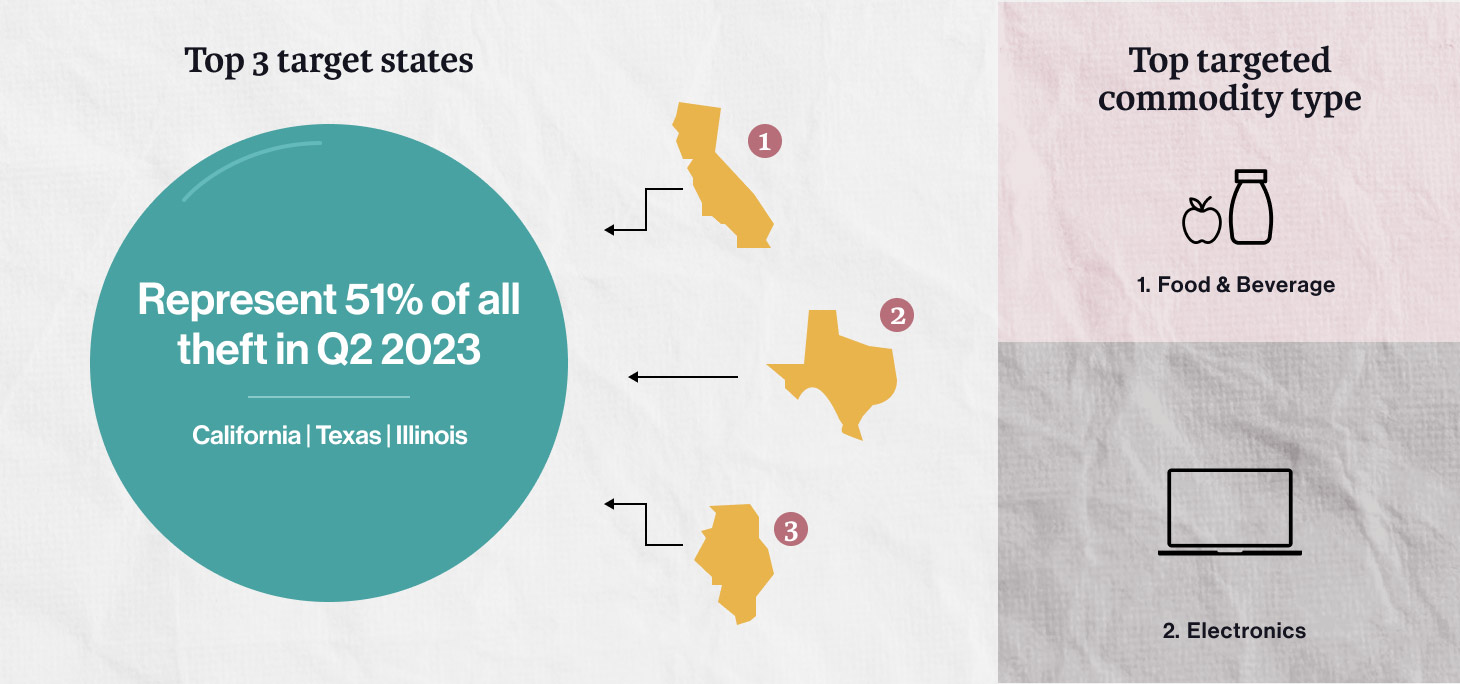

Although there was a decline in recorded U.S. and Canada cargo theft incidents in 2020 and 2021, 2022 saw an overall 15% increase over 2021 and thus far the 1st and 2nd quarters of 2023 show increases of 30% and 57% over the respective quarters in 2022. Certain types of commodities have seen consistent increases. This includes theft of basic goods like furniture, tools, toys, electronics, food, beverage, automotive parts, and fuel. This change can be attributed to the impact of inflation and other economic shifts that affected criminal patterns. In the 2nd Quarter of 2023, CargoNet recorded 127 more fictitious pickups year-over-year. primarily focused their efforts on a smaller grouping of freight. This includes alcoholic beverages, non-alcoholic beverages, specifically soda and energy drinks, solar power energy generation equipment, and various kinds of automobile supplies including auto parts, fluids, oils, and tires.

Moreover, the way thefts occur has also been evolving. While 2021 was marked by thefts during long idle times and cargo at rest, 2022 and 2023 has seen a return to theft patterns reminiscent of pre-pandemic levels, such as thefts from facilities and from containers or trailers.

Inflation and Its Impact

The global economic environment in 2022 was shaped significantly by inflation, with many countries experiencing the highest inflation rates in decades. Notably, this inflation has driven criminals to target basic goods, as rising prices have created a demand for cheaper, illicit goods. For instance, the rise in fuel prices in the U.S. during Q1 2022 saw petroleum/fuel thefts accounting for 12% of all recorded incidents.

Food & Beverage: A Prime Target

In the past, luxury items and electronics often became the prime focus of theft. However, recent economic shifts and the subsequent supply chain disruptions have pushed food and beverage items to the top of cargo thieves’ target lists. This trend isn’t just a temporary blip. An industry theft specialist for a major insurer provides historical context, citing a similar focus on these commodities during the 2008 financial crisis. This trend persisted for over a decade, demonstrating its enduring nature.

Moreover, data corroborates this narrative. Recent statistics from CargoNet show a shocking 50% year-over-year increase in food and beverage thefts. This percentage isn’t just a statistic—it translates to a higher cost for consumers, potential losses for brokers, and a more complex risk landscape to navigate.

The Changing Face of Theft Across American Cities

Cargo theft is an adaptable crime. As countermeasures become more sophisticated in traditional hotspots, thieves branch out to exploit new vulnerabilities. Los Angeles, Houston, Miami, and Chicago are among the cities that have historically faced such challenges. While these remain prime areas of concern, new areas emerge in the national theft landscape.

Inland regions like Memphis, which effectively act as inland ports due to their heavy rail infrastructure and dense populations, are seeing a marked uptick in theft. It’s not just about the coastlines or border areas anymore; the interior of the United States is equally at risk.

Furthermore, the method of theft is diversifying. Not all crimes occur at the point of loading or unloading. Some thieves, recognizing the strategic significance of areas with a dense combination of ports, warehousing, and rails, stage their operations well in advance, making them harder to anticipate or counter.

The Changing Face of Theft Across American Cities

In our digital age, the logistics industry isn’t just transporting tangible goods—it’s also managing vast amounts of data. This shift towards electronic operations brings with it a new breed of cybercriminals ready to exploit any vulnerability in the system.

An industry theft specialist at a major Insurer has referred to this phenomena as “strategic theft.” Here, cyber thieves don’t physically steal goods. Instead, they impersonate legitimate trucking companies, exploiting digital freight management systems to orchestrate fake pickups. A shocking 600% annual rise in such thefts offers a grim reminder that the threats aren’t exclusively physical.

These cybercriminals often conduct rigorous surveillance around distribution centers, studying the movements and operations of legitimate trucking companies. With this data, they can convincingly pose as these companies, secure goods for transport, and then vanish.

The Need for Comprehensive Coverage

In light of these emerging and diverse threats, Freight Brokers must reevaluate their insurance strategies. Cargo loss or damage that is not covered by the motor carrier or their Insurer is at best a source of friction in the Broker/Shipper/Customer relationship and at worst may result in lost business or legal disputes. Many Polices offered today may not account for the complexities of the current risk landscape. With cargo theft costing the industry between $15 billion to $30 billion annually, according to the FBI, there’s too much at stake.

It’s essential to ensure that coverage is holistic, encompassing not just traditional theft but also cyber threats. Incomplete insurance coverage could leave brokers exposed to significant losses, and damage to their reputation, undermining trust with their clients.

The Solution: Broker Shield

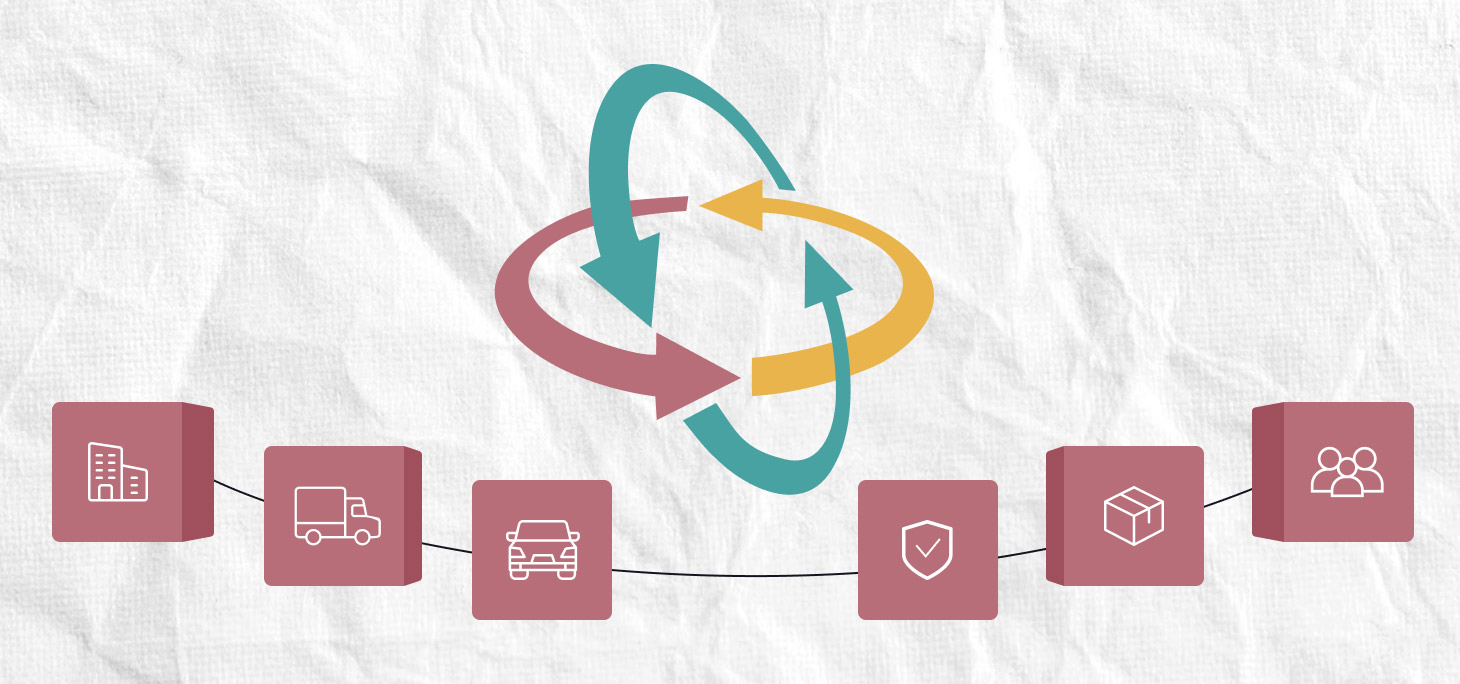

Enter Broker Shield—a state-of-the-art insurance solution tailored specifically for Freight Brokers. Designed with an in-depth understanding of the industry’s unique challenges, Broker Shield provides robust protection against both physical and cyber theft.

With Broker Shield, you aren’t just purchasing an insurance policy—you’re investing in protection of your business relationships and even peace of mind. Our comprehensive coverage ensures every facet of your business is safeguarded. From direct theft losses, theft/incidents resulting from fraudulent carriers, to damaged cargo, Broker Shield offers a 360-degree safety net. It’s a testament to our commitment to keeping the freight brokers business model strong and secure.

In Conclusion

The cargo theft trends in the USA are clear: risks are evolving, and the stakes are high. Freight brokers sit at a critical junction in the logistics ecosystem, making them uniquely vulnerable. Now, more than ever, it’s crucial to ensure comprehensive insurance coverage. Broker Shield promises to be that guardian, ensuring that brokers, their shippers, and the broader supply chain remain resilient in the face of threats, old and new. Don’t leave your business exposed— ask us about Broker Shield today!

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747