The freight broker industry is changing at a rapid pace. As more businesses moved to e-commerce, which was even more accelerated by the quarantines of COVID-19, the need for shipping services increased exponentially, and more motor carriers and freight brokers attempted to enter the market. With more freight broker competition, it may seem enticing to make certain allowances in your contracts with your shippers to close the deal.

However, the reality is that litigation is also on the rise and certain contract concessions may open up your freight broker firm (and your shipping client) to more liability than you realize. Becoming educated on the real risks that the shipping industry currently faces and selling your potential shipping clients on how your freight broker services help protect them, will not only differentiate you from your commodified competition, it will also protect your ability to continue operating.

Litigation Trends in the Domestic Shipping Industry

As a freight brokerage operator, you have a lot to manage to remain competitive and profitable in your day-to-day business. Most freight brokers and shippers are focused on the timetables of getting a product from Point A to Point B in the fastest and most cost-effective way possible. The potential liability risks of motor carrier accidents aren’t always on the radar as a problem that needs to be addressed… until it’s too late.

With the number of domestic motor carrier deliveries on the road today, the odds of them being involved in some sort of accident is not so much an issue of “if” they will, but “when” they will. Consider these statistics:

- There are 4119 fatalities annually involving large truck accidents (11 fatalities per day)

- There are approximately 160,000 injury accidents with bodily injury (438 injuries per day)

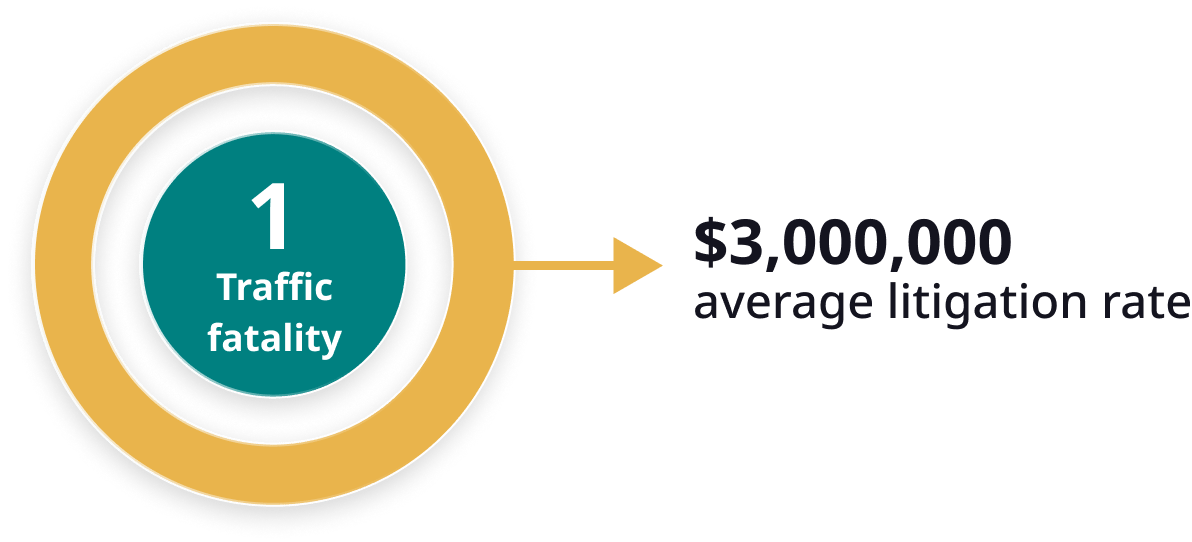

Even with skilled vetting of your motor carrier providers, the industry inherently carries the risk of accidents and loss of cargo. Most motor carriers have about $1M of auto liability coverage. With the average litigation rate of $3M per traffic fatality now, attorneys are looking to pull in any potentially related party to get the desired settlement for their client. And guess what? There is currently no downside for a plaintiff to drag every party involved in a shipping arrangement into litigation in domestic transit shipping.

Average Litigation Rate Per Fatality

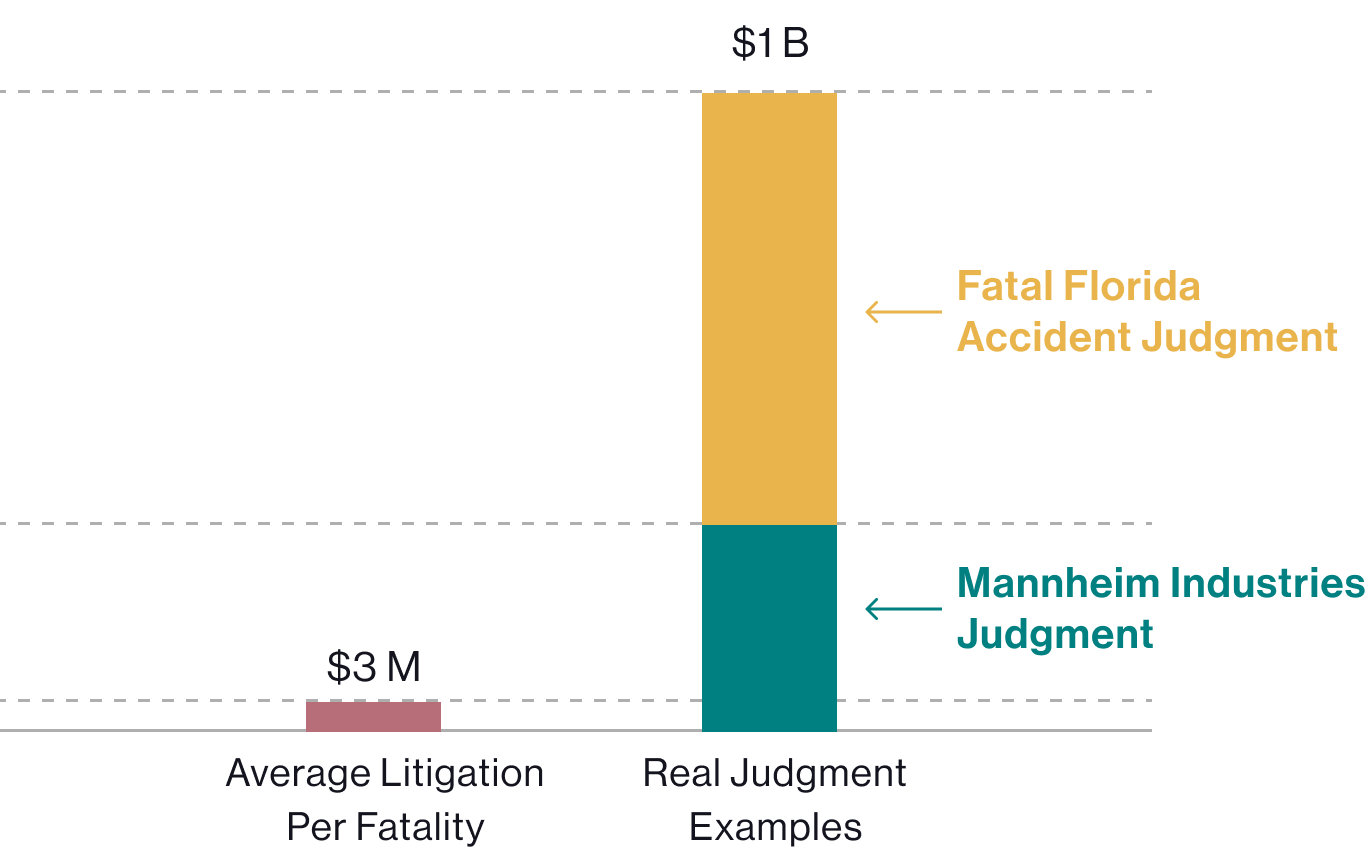

There are also no tort reform laws to limit judgments against motor carriers. In recent years, nuclear verdicts have been delivered against shippers, freight brokers, and motor carriers with no upper limits on the amount of litigation exposure. Mannheim Industries was hit with a $30M judgment in Southern Florida State Appellate Court after contracting directly with a motor carrier who was involved with an accident. In 2021, a record $1B (yes… billion) settlement was levied against a motor carrier for an accident in Florida that involved one fatality. It goes without saying that these types of accidents, without proper insurance coverage and contract language, can fold a business.

Motor Carrier Judgments

Two Primary Risks for Freight Brokers

As more and more freight brokers are being pulled into motor carrier litigation, there seems to be a difficult trend in what freight brokers are being found liable for: either the freight broker didn’t do enough work or the freight broker did too much. It is a delicate balancing act in contract language and behavior of the freight broker’s firm to protect themselves.

Allegations of Negligent Hire is when a freight broker is found to be a responsible party in an accident because they did not do enough work to vet the credentials and reputation of the motor carrier. Freight brokers can help mitigate this risk by doing the following:

Validate that a motor carrier has valid authority in place.

Have they met compliance requirements and can they legally offer the types of services they’re providing?

Consult the Department of Transportation safety scoring for motor carriers.

They will have a rating of Satisfactory, Unsatisfactory, Conditional, or Non-Rated. Unfortunately, the Federal Motor Carrier Safety Administration does not have the resources to give all motor carriers a rating. In fact, 85-90% of truckers on the road do not have a safety rating. Even still, this can be an overlooked step that reflects poorly on the freight broker if they do not perform their due diligence.

Verify that the motor carrier has a valid insurance policy in place

The freight broker must get the insurance coverage details from every motor carrier they contract with. The insurance underwriter should have thoroughly evaluated the motor carrier’s past claim history, financial records, past hiring and firing practices, and maintenance records. This is used as primary defense against negligent hire.

Allegations of Vicarious Liability are where more freight brokers (and shippers) are finding themselves ensnared in unexpected litigation. Companies are overreaching and doing too much in an effort to exercise control over the motor carrier by the freight broker (or exercise control over the freight broker by the shipping company),. Freight Brokers may overreach their control by establishing penalty schedules for the motor carrier’s drivers or having a hand in the motor carrier’s human resources processes. One freight broker was found to be vicariously liable due to calling themselves a “One Source Solution” for shipping in their advertisements. Such a claim made it appear that the motor carrier was somehow related to the freight broker business rather than operating as a separate entity.

Two Primary Risks for Freight Brokers

- Allegations of Negligent Hire

- Allegations of Vicarious Liability

Making Sure Your Shipper/Broker Contracts Are Not Putting You at Risk

With the recent trend in increased auto litigation, the cost of auto liability insurance has also increased. This cost increase has resulted in large and mid-size motor carriers reducing their coverage limits in an effort to offset the increased insurance cost. These lower cover limits only further open up freight brokers and shippers to potential litigation.

As a result, shipping companies are now modifying their contract language to try and protect themselves from this litigation. The shipping company’s attorney may strive to draft contracts that transfer the liability on to the freight broker. What many don’t realize, though, is that this is a short-sighted approach that actually opens up the shipping company to an INCREASED liability risk. Why is that? Again, it goes back to vicarious liability and the shipper overstepping the boundaries with freight brokers.

When reviewing contracts with your potential shipping clients, it’s important to keep your eyes open for language that may open them up to vicarious liability. Some ways in which specific contract verbiage does this can entail: any mention of having a hand in anything involving the motor carrier (including maintenance requirements), performing anything related to the Human Resources function of the freight broker or motor carrier, or offering misleading marketing claims where the shipper appears to be stepping into the responsibilities of the freight broker or motor carrier.

Your shipping client may be initially put-off by being asked to remove such language from the contract. However, if you have a solid understanding of your insurance coverage and the coverage of the motor carriers your freight brokerage firm contracts with, you will be able to differentiate yourself as a player who truly understands the industry and can provide MORE protection to the shipper.

Educating Your Shipping Clients About Freight Brokerage Protection

While we’ve focused much of this article on the potential liability that freight brokers have with their motor carriers, it’s an important topic to understand when selling to a potential shipping client. As shipping clients may still be considering the option of contracting directly with a motor carrier, being able to speak to the specific risks that doing so carries for them will help add additional value to your freight broker services. With more than 17,000 freight brokers vying for shipping contracts in the US alone, building a solid rapport with your shipping clients will help ensure long-term relationships based on trust and mutually-beneficial contract policies.

First, explain the current litigation risks in the market to your shipping clients and the fact that they may be held liable both when using a freight broker or when contracting directly with a motor carrier. It is then important to highlight that having a freight broker inherently helps limit their potential exposure as the shipper is now one additional step removed from the motor carrier’s liabilities.

Using a freight broker further mitigates the shipping company’s risks by providing experienced and thorough vetting of the motor carriers. This may reduce the shipper’s potential exposure for allegations of negligent hire as the freight broker now takes on the motor carrier hiring responsibility. The contract between your freight brokerage firm and the motor carrier, if strategically written to ensure no language that could lead to allegations of vicarious liability, further protects the shipper from that potential legal battle as well.

Lastly, a freight brokerage firm with a solid insurance coverage plan, such as Broker Shield, can demonstrate the layers and levels of insurance coverage provided that further augments the insurance coverage carried by the motor carrier and reduces the shipping company’s exposure. Once the shipping company understands the risks from overreaching contract language and the insurance coverage amounts that are already in place by using a freight broker, the value of your services will become even more apparent. And because few freight brokers are currently having these conversations with their potential clients, you’ll differentiate yourself in the market as well and strengthen your reputation.

Becoming Educated in the Value of Your Freight Broker Insurance Coverage

We understand how busy you are. You have a lot on your plate when it comes to running your freight broker business, and insurance is not the most exciting of topics to study. However, when you view your insurance coverage as a potential tool for business growth rather than just an overhead expense, it becomes more enticing to understand exactly what you’re purchasing and how it can serve the best interest of your shipping clients and motor carriers.

At LogistIQ we are dedicated to building strong partnerships with both the insurance agents that carry our products and the freight broker clients they serve. With over 45 years of experience in the industry, we are committed to staying on top of industry trends and providing innovative ways to keep our clients competitive in an industry that can easily appear to be commodified. Freight broker protection is all we do.

Let’s start the conversation today about what types of coverage can best help you meet your goals for growth and give you a competitive edge in the market today. We are happy to provide you with the resources you need to educate your potential shipping clients about the protection you can offer to them. Contact us at info@logistiq.com or call us at 1-888-465-0828.

In the meantime, keep a keen eye on your shipper/broker contract terms. When it comes to safe contract language, it’s really an important time to make sure that everyone is staying in their own lane!

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747