Read time: 5 minutes

What Exactly Is Excess Motor Truck Cargo Insurance?

The name Excess Motor Truck Cargo Insurance is somewhat self-explanatory– it is extra insurance coverage for cargo that goes above the amount of insurance held by a motor carrier. The more common question we hear is, “Why would I need to have any extra coverage if the motor carriers I am contracting with are insured?” While in a perfect world motor carriers would always be insured for the full valuation of their cargo loads, the reality of today’s market is that they are not. Excess cargo insurance is an essential aspect of commercial truck insurance, providing protection for your freight broker business against potential cargo mishaps and related litigation. Additionally, it serves as a valuable tool to instill confidence in both your current and prospective shipping clients.”

Reasons Why You Need Excess Motor Truck Cargo Insurance

Reason #1: Your Motor Carrier May Not Be Adequately Insured

During the vetting process, you have undoubtedly checked the trucking insurance policy and coverage limits of the motor carriers that you’re contracting with as part of your due diligence. However, just because a motor carrier has insurance, does not mean that it is always sufficient for the cargo loads they’re carrying.

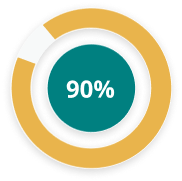

Currently, 90% or more of the Department of Transportation (DOT) Registered Motor Carrier force consists of small carriers with less than 10 units, or independent owner operators. These small motor carriers often have limited insurance choices available to them. Even more common, they may lack the financial resources available to acquire the levels of insurance needed to cover the value of their cargo.

Independent Owner Operators in the DOT Registered Motor Carrier Force

Independent owner operators (small carriers with less than 10 units) make up 90% of the DOT Registered Motor Carrier Force

Fixing this solution is not as easy as just asking your motor carrier to increase their Motor Truck Cargo Insurance policy level. Because the motor carrier’s insurance is typically the first line of defense in covering a lost or damaged cargo claim, motor carriers are often restricted by the amount of coverage that they are able to buy and at an amount they can afford.

Reason #2: You Can Attract More Valuable Shipping Clients

The freight broker industry is evolving, but perhaps no time more rapidly in recent history than just the past few years. More freight brokers continue to enter the market as the need for domestic shipping options continues to increase. This means that shipping clients also have more options than even when it comes to contracting with a freight broker.

If one of your business goals is to attract new and larger shipping clients, Excess Motor Truck Cargo Insurance is one way to do that. It allows you to impress upon your potential shipping clients that a motor carrier’s coverage alone may not cover the full value of their cargo (one more reason to use a freight broker as an intermediary). Your additional insurance coverage will position you as a reputable protector of your shipping clients, who is proactive at mitigating risks.

When a freight broker provides for or arranges for the purchase of Excess Motor Truck Cargo Insurance, the broker demonstrates that they are willing to take all steps available to them to protect the interests of their shipping clients. That speaks volumes in terms of building client trust.

Reason #3: It Can Improve Relationships With Your Current Shipping Clients

We’ve seen it happen before– a motor carrier has an accident with damage to cargo and suddenly the shipping client is threatening to end their relationship with the freight broker that facilitated the transaction. This happens most often when a shipper feels that their freight broker did not perform their due diligence in vetting the motor carrier and ensuring that the value of the cargo was sufficiently covered.

While it’s impossible to control motor carrier accidents from happening, how your company responds to the accident is what makes all the difference in preserving your reputation. The existence of the Excess Motor Truck Cargo Insurance coverage is a means of augmenting the broker’s shipper/customer relations, by diminishing or eliminating a source of friction that might otherwise exist if the motor carrier’s insurance proves inadequate in the event of a cargo loss.

“Reasons You Need Excess Motor Truck Insurance:”

- Your Motor Carrier May Not Be Adequately Insured

- You Can Attract More Valuable Shipping Client

- It Can Improve Relationships With Your Current Shipping Clients

How Can Excess Motor Truck Cargo Help Your Business?

LogistIQ has been operating in the freight broker insurance industry for over 40 years. In that time, we’ve seen the value that having an Excess Motor Truck Cargo Insurance policy can have to help freight brokers not only protect their shipping clients, but also to protect themselves. If and when an accident happens, you do not want your business to be at risk due to a motor carrier’s insufficient insurance. Many clients are surprised at the relatively low cost of adding Excess Motor Truck Cargo Insurance, particularly when they realize how they can use that coverage as a sales tool.

In an industry where differentiation can be hard, we like to support our clients in positioning their insurance coverage as a unique value proposition. It is one way that freight brokers can offer superior customer service and protection to their clients. Shippers want to know that their freight broker has taken every measure to ensure the protection of their goods.

To do so, however, you need to have a sales department that is knowledgeable both in the current levels of insurance held by your motor carriers, and in the types of insurance policies that your company carries as additional protection. This enhanced sales pitch will better position you to achieve the growth goals you’ve been working towards.

Explore Your Motor Truck Cargo Insurance Options

Don’t let overwhelm stand in the way of exploring your freight broker insurance options. Our Broker Shield program at LogistIQ has been designed with your success in mind. Contact us today for a free consultation to see how Excess Motor Truck Cargo Insurance can serve you!

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747