Your TMS offers – nearly- everything that your customers need. They can quote, book, and track all of their shipments with a click of the mouse. But can they purchase excess cargo insurance directly within your TMS platform?

With more and more Transportation Management Systems offering excess cargo insurance options natively in their system, now is the time to start evaluating your insurance integration options if you’re leading a TMS company.

With a variety of insurance providers across the market, it can be overwhelming to think about all of the considerations and questions to ask potential partners. That’s why we’ve compiled this list of the top three tips that TMS executives should consider before selecting an insurance partner.

What exactly is an integrated cargo insurance solution?

An integrated cargo insurance solution allows TMS companies to offer cargo insurance directly within their TMS so their customers, whether they are brokers or shippers, can secure insurance coverage on one or all of their shipments.

One of the most popular types of cargo insurance is excess cargo insurance. This is commonly also referred to as “spot insurance,” “single trip cargo insurance,” or “per-load cargo insurance.”

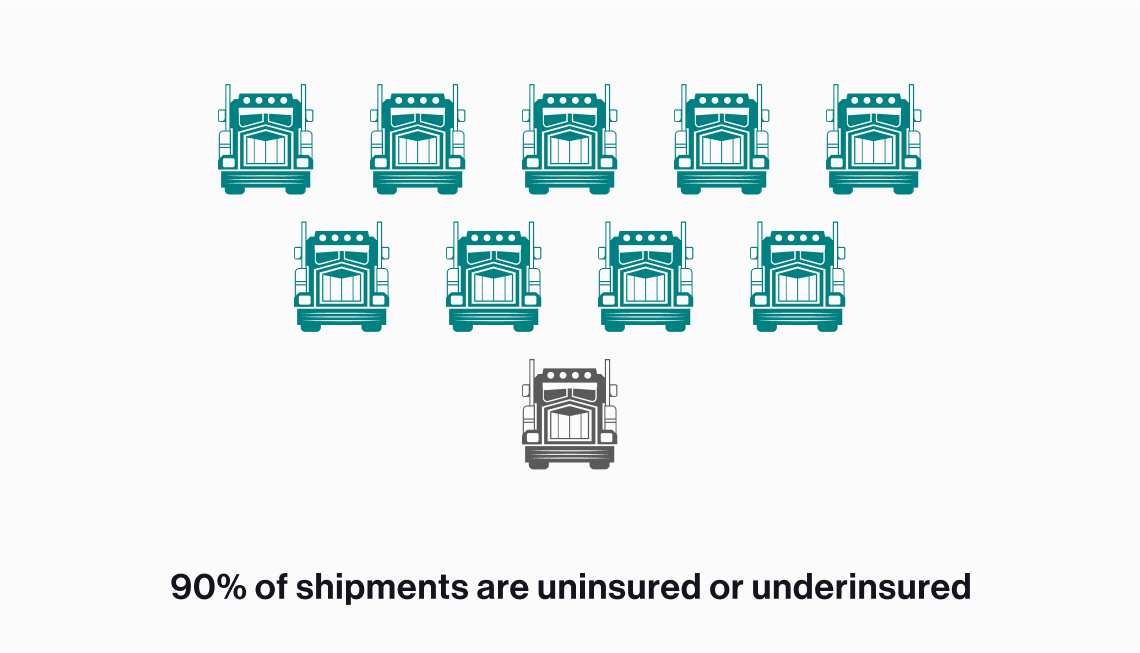

Excess cargo insurance is commonly used as an additional layer of protection when it comes to shipping full truckload (FTL) freight because a shipper’s goods may not always be completely covered by the motor carrier’s primary cargo insurance policy.

Why even offer cargo insurance directly within your TMS?

We know what you’re thinking – your TMS development roadmap is already busting off the page and you’re playing feature tetris as you try to balance what your customers want with what your team can handle.

And while new features are great for your customers, how those features will impact your bottom line will always be top of mind.

This is why every time we talk to CEOs of TMS companies, we commonly hear one thing. They choose to prioritize the addition of an insurance offering because it translates directly to immediate revenue growth. The TMS company is often charging a technology fee to handle the facilitation of the transaction. And when you multiply that by thousands of transactions per month, the financial upside becomes crystal clear.

Not to mention offering cargo insurance directly within your TMS is a great way to add value for your customers. New tools that can create workflow efficiencies continue to gain traction and that’s precisely what an integrated insurance offering does for your TMS – it gives customers a one-stop shop for all of their freight needs.

Why is the option to secure cargo insurance becoming expected in a TMS?

While cargo insurance has always been available to shippers and brokers, the shipping community is now starting to expect to be able to secure coverage directly within their TMS.

Simply put – the old way of securing shipment-level cargo insurance isn’t cutting it anymore. Brokers and shippers don’t want to take the time to go to a standalone insurance website, manually key in their shipment details (yet again), download the insurance certificate to their computer, save it, and upload it back into their TMS.

It’s time consuming and inefficient. Which is why an integrated insurance solution is becoming more and more important as leaders evaluate their options when it comes to a new TMS.

While knowing that your customers would benefit from adding an integrated insurance offering to your TMS, there are some critical factors to consider as you start your research. To help TMS executives navigate this process, our team has compiled the top three tips to consider when adding an integrated insurance offering.

3 Key Tips for TMS Executives Considering Adding an Insurance Offering

- 1. Understand how the integration will be managed.

- 2. Understand the claims process.

- 3. Understand the plan for user adoption

Tip #1

Understand how the integration will be managed.

Every technical integration is unique. Some are easier than others and this is certainly true when it comes to TMS integrations. The first area to focus is how the insurance company plans to approach the integration which commonly includes digging into their technical capabilities and available documentation.

You’ll want to look for an insurance provider that has an established, and proven, process for their integrations. It’s also important to understand if they already have an API, which avoids wasted time and unnecessary hurdles compared to if they’re developing the API in real time.

A team of technical resources available to you throughout the process is also an important box to check so you have the confidence that you’ll receive the assistance you need during the process.

Outside of technology providers, a substantial portion of the transportation industry is still lagging compared to other industries. While API technology has been around for years, portions of the transportation industry can still be antiquated. Lookout for potential issues such as an individual API having to be developed for each line of insurance.

Ask questions like:

- Can you share an integration roadmap?

- How many APIs will be part of the integration?

- Can you share more about your developer team and their availability to help should we need it?

- How long does the integration typically take?

- How many hours should we expect our team to need for their portion of the integration?

- Do you have references from previous integrations?

Tip #2

Understand the claims process.

Claims are inevitable in the world of transportation. While it’s a monumental win to be able to offer insurance directly within your TMS, it can quickly become a failure if your customers have a frustrating claims experience.

Freight is bound to get damaged or lost and understanding the insurance provider’s claims process ensures you’re setting both yourself and your customers up for success.

Consistent with many other processes in the transportation industry, the claims process can often still be extremely manual which creates painful inefficiencies and headaches.

One of the biggest issues to look out for is having to submit claims paperwork via email. The leading insurance providers have built automated workflows to streamline claims procedures and improve their customers’ experience.

When it comes to a seamless experience, it’s helpful to seek out a partner that has a digital process for submitting the details of the claim and required documentation.

Once a claim has been initiated, ensure your partner’s standard operating procedure includes immediately delivering an Acknowledgement, assigning a claim adjuster, and communicating how the claim will be handled.

Look for a partner that also provides clear instructions on how claims can be initiated directly on each certificate of insurance (when they purchase the insurance). This gives your customers, whether they’re brokers or shippers, an easy reference to the process they need to follow in order to initiate a claim.

Lastly, when it comes to timing, be sure to ask if there’s an expedited claims process for quickly paying claims that include all of the required documents and are under a certain monetary threshold (typically a few thousand dollars).

Ask questions like:

- What does the overall process for claims look like?

- How is claims paperwork submitted?

- What is the required documentation to submit a claim?

- How quickly are claims typically resolved?

- Is there an expedited process for claims that are under a certain value threshold?

Tip #3

Understand the plan for user adoption.

Everyone knows that simplicity is bliss and this will always be true when it comes to technology. If your TMS users can easily add insurance, they’ll be far more likely to go ahead and secure the coverage, which translates to revenue for you.

To maximize user adoption, make sure the user’s ability to add on the insurance coverage is at a natural part within their workflow. For example, embedding the insurance offering directly within both the quoting and the booking screens are great best practices. However, each TMS is unique so look for a provider that will work side-by-side with your internal design and development team to identify the most user-friendly ways to integrate the insurance offering into your TMS.

Building the integration is just the beginning though. Once the integration goes live, you’ll want to begin sharing the exciting news about your newest TMS upgrade. As with any new offering, there are a number of strategies you can use to help raise awareness and drive adoption within your customer base.

One of the most successful strategies includes the development of educational marketing content. Educating your customers on the value of cargo insurance will be an important factor in adoptability. Look for a provider that will work with your internal marketing team to deploy educational marketing campaigns that drive awareness of the importance of securing cargo insurance on every shipment.

Ask questions like:

- How will your team help guide our design and development teams during the integration?

- Do you have a marketing and communications framework we can use when announcing our new insurance offering?

- How do you help us educate our customers about the importance of cargo insurance?

How LogistIQ Helps TMS Companies Stay Ahead:

LogistIQ partners with TMS companies around the world to offer seamless insurance solutions directly within their TMS platform. With a proven integration process and decades of experience in the transportation industry, we can help bolster your TMS’ competitiveness.

With all of our integrations we:

- Have a Proven Integration Playbook

Our comprehensive API documentation ensures your team has a detailed roadmap, from start to finish. We have one single API which covers all of our insurance lines, making the integration extremely simple to manage. We also give you a dedicated point of contact that will coordinate everything between your team and our technical experts, ensuring you are supported throughout the integration process. - Pride Ourselves on Delivering an Exceptional Claims Experience

We’re one of the few insurance providers that has automated the claims process within TMS platforms. This gives us the ability to immediately issue the claim number and assign it to an adjuster. We also offer expedited claims processing when a claim falls under a certain value threshold. Our commitment to customer service means you’ll receive proactive communication regarding the status of a claim and benefit from expedient payments once a claim has been accepted. - Share Our Proven Strategies to Increase User Adoption

Our decades of experience in freight is one of the key ways that we’re different. This means you get access to insights and content, like co-branded marketing campaigns, that helps you quickly and easily engage your customers. We’ll also work closely with your design, development, and marketing teams to identify unique ways that we can further increase adoption.

LogistIQ Solutions for TMS Companies

By offering an excess cargo insurance solution directly in your TMS, you can give your clients a one-stop-shop while also creating an opportunity for additional revenue, if you choose to do so.

Contact us today or download our Free TMS Guide to learn more about how LogistIQ’s Freight Insurance Fast for TMS companies has everything your organization needs to provide spot insurance directly within your platform.

How To Move Forward

For Freight Brokers

We will connect you with a qualified agent that best meets your needs.

1-888-910-4747

1-888-910-4747